FreightTech Trends: Accelerating the Transportation Industry

The trend of digitalization and tech-reliance in freight shows no signs of stopping. Technology allows freight forwarders to optimize their coordination and maximize control, and it is clear that the future of logistics will belong to the companies who can keep up with the times.

ReportLinker mentions the global freight transportation market will reach $7.8 trillion by 2027. This market research stresses that in the coming years, we’ll face a global shift in the vision of freight technologies as demand for transportation agility increases, as does the creation of integrated logistics services accessible on demand.

- The market has become more and more challenging:

- Web-based retail channels are changing the nature of demand

- Personalization and customization of services is rising

- Growing investments in road infrastructure is pushing the efficient use of transit

These developments encourage logistics providers to innovate, accelerate digital transformation, and stay aligned with the latest freight tech market trends.

Freight Transportation Market Overview

In an overview on the GrandViewResearch website, “urbanization” and “communication innovations” are shown to be the key global factors amplifying the freight market by 2025. Substantial market growth is pushed by:

- Innovations in freight delivery processes

- New networks with secure contacts and speedy transaction times

- Demand for more reliable shipments that comply with international regulations

- Freight transportation revenue covers one-third of logistics costs, yet barely influences the logistical software system’s performance

- Local and small players hoping to compete in the global arena by using efficient high-tech freight transportation management systems (TMS)

- Clients trying to deliver freight on time at a lower price.

DataBridge, an e-science collaboration environment tool for big data analyses, performed research where they forecast freight market growth at a rate of 6.6% in the period of 2021 up to 2028.

Every transportation sector; air, truck, rail, ocean, and other grows – and this proves the growth of the entire freight industry.

For example, Allied Market Research evaluated the global air freight market at $270.2 billion in 2019 and its expected growth up to $376.8 billion in 2027 with a CAGR of 5.6%. This mode of transportation is evolving from the old mainframe systems to more adaptable interfaces utilized for flight operations management, revenue accounting, and networking planning.

Airfreight transportation providers offer charter, standard, deferred, and consolidated delivery options. The technological shift is more apparent in consolidated deliveries serving fast and efficient logistics with a full aircraft load at lower costs. The focus in this freight industry segment is on flexible transportation to meet specific customer’s needs.

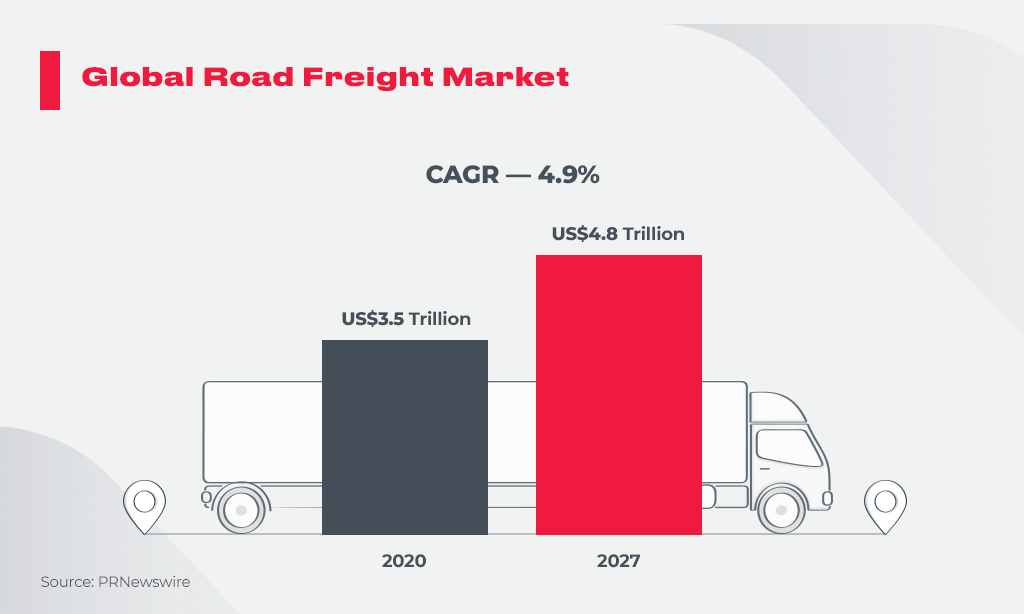

The road freight transportation market is driven by the necessity to boost operational efficiency by a factor of freight tonnage expanding as well as by development shifts in the automotive industry (e.g., self-driving cars). The North American market is now projected to grow by $103.29 billion during 2021-2025 at a CAGR of 2.31%.

The global truck transport market seems to be even more dynamic and is expected to reach $215 billion in 2025 at a CAGR of 8%. We can explain this boost by the faсt that the industry has started to recover from the pandemic.

What encourages such high market growth and makes freight companies implement innovative technologies?

The necessity to cover wider markets and ship safely and quickly has pushed the freight industry to undergo some changes. Companies have started to empower their operations with smart technologies to be able to satisfy extraordinary demands and preserve customer loyalty. Let’s see some of the measures the global giants have taken to innovate and become technology-driven.

Mobility-as-a-Service

Lukas Neckermann, an expert, author, and speaker for the mobility revolution outlines that modern “zero” demands drive changes and make freight companies implement innovative technologies.

In his book, The Mobility Revolution, he identifies three zeros shaping the innovations:

- Demand for zero emissions to be sustainable and prevent pollution

- Zero accidents to deal with the transportation risks

- Zero ownership to optimize delivery costs

Companies have huge budgets for sustainable transportation. JBF said many of their customers have a $100+ million annual budget for transportation. Because of such large investments, they tend to buy and own transportation systems that are empowered by innovative technologies.

Mergers and Acquisitions

Over the last few years, we have seen partnerships forming in every facet of the transportation industry, including some mergers and acquisitions aimed at service innovation. Powerfleet, a giant in IoT SaaS solutions, recently acquired Movingdots, a provider of insurance telematics and sustainable mobility services. Hendrik Todte, managing director at Movingdots, acknowledged the potential of this deal in the corporate and commercial fleet space, expressing eagerness “to deliver innovation in mobility through cutting-edge technology”.

S&P Global Mobility has decided to strengthen their sales optimization tools with the acquisition of Market Scan Information Systems, a leading provider of automotive pricing and incentive intelligence. S&P Global Mobility’s Joe LaFeir anticipates that additional datasets will benefit their clients, and the new data and payment calculations will sharpen Global Mobility’s pricing predictions.

Year after year, the digital landscape integrates a greater quantity and higher quality of data. Many current mergers and acquisitions occur to add new technologies that turn that data into profit. Standing at the core of data management is a crucial element of digital transformation – migration to cloud.

Migration to Cloud

Cloud computing has become a game-changer for the transportation industry, bringing opportunities such as on-demand service scalability, solid data protection, and significant cost reduction. Global giants understand the value of cloud technologies and are actively planning to move their operations to the cloud. This is one more tech challenge pushing organizations to innovate.

Ramond Coleman, former Senior Manager at Capgemini, says that the cloud is making transportation services more accessible to shippers and carriers and develops a “sandbox” for technology providers who search for building cloud-based supply networks.

In 2022, the trucking technology supplier Trimble, partnered with Microsoft to scale up its Trimble Transportation Cloud platform. According to Trimble CEO Rob Painter, Trimble’s accelerated migration to the cloud will “empower carriers, shippers and brokers to work better together and improve freight management from procurement to planning to execution”. What’s stopping other companies from expanding their cloud-based services?

Growing Competition

The quality of transportation services is growing from year to year. This urges providers to reconsider their approaches and find new technology-driven solutions to tackle specific demands and problems more effectively:

- JIT (just-in-time delivery) to increase customer satisfaction and loyalty

- Cold chain logistics applications to comply with the new vaccine regulations

- Self-driving vehicles to exclude the “human factor” in shipping, and more

A 2022 Deloitte research article distinguished five drivers of the future of transportation:

- Onshoring and nearshoring: manufacturing will move closer to the end consumer to decrease risks.

- Digital transformation and control over data will dictate leadership in the industry.

- Newcomers will encroach upon and threaten legacy logistics.

- Building or acquiring new core capabilities is a must.

- The influx of next-generation new vehicles is on the horizon – prepare for competition.

These are only examples of technologies that are going to reshape the freight industry. Let’s see in detail what tech trends are forming the present and future of transportation.

Technology trends to help freight companies gain a competitive advantage and boost profits

The theory part of the “Future of The Transport Industry” report illustrates an overall profile of the innovation efforts performed both by the public and business sector as well correlation between innovation and competitiveness.

To increase GDP and productivity, optimize employment, fulfill trade balances, cover new market shares, and boost turnover, companies follow a number of logistics industry trends which we identify below.

Edge Computing to Deal with Massive Volumes of Data

Carriers of all sizes are striving to achieve better control over their fleets, driver locations, and hours they spent driving. Unlike cloud computing, which helps gather data remotely and transmit it in a clear format for tracking your fleet in real-time, edge computing picks, processes, and analyses data at the point nearest to data origin.

New distributed edge computing architecture is focused on dealing with the telematics data within the vehicle cab no matter whether or not it’s located within the network with availability to a data connection. Using edge technology, companies can be sure data is picked and stored precisely and will be synchronized as soon as network and service become available.

Edge computing deals with an immense amount of data produced by autonomous vehicles. It’s calculated that one self-driving car produces about 30 terabytes of data per day, and on US roads alone, there are over 250 million cars. You can imagine what would happen if only 1% were replaced by the self-driven ones. The industry should be ready to cope with the burden of big data generated. Edge data centers play a significant role in serving extra computer power for performance-critical analytics near the end-user. According to Analyses Mason, we can expect that edge computing will reduce costs by 10-30%.

Case

Nokia launched a MEC (multi-access edge computing) platform that promises latency below 20 ms, providing a flexible deployment model. They demonstrated how MEC technology can save lives during a 5GAA Connected and Automated Driving Workshop in Berlin. MEC-equipped cars receive warning about road obstacles in real-time as well as HD geo data is transmitted in milliseconds making driving safer.

Processing data is crucial for lowering risks, optimizing functionality, and making freight and fleet communications available everywhere. Edge computing deals with data while RPA is focused on the freight transportation processes (being another trendy technology in the future of logistics).

RPA for Smooth Freight Transportation Operations

Fortune Business Insights has calculated that the global RPA market was valued at $10 billion in 2022. According to their trends analysis, it is projected to grow from $13.86 billion in 2023 to $50.5 billion in 2030. Robotic Processes Automation assists in:

- Scheduling and tracking shipments: reporting shipping details inside shipping portals and extract them out from the calls or emails to provide users with the details of the planned freight shipping.

- Processing invoices and credit collections: “getting paid after service delivery” is one of the biggest challenges, especially in 3PL logistics. RPA is able to automate the whole order-to-cash process.

- Capturing, researching, and closing out loads: third-party carriers provide endless opportunities for your business to grow, but at the same time, freight amount increase leads to a boost in the tracking data necessary to process. RPA can serve the needs of LTL (less-than-load) shipments and manage numerous freight deliveries.

- Automating order processing, mail communications, and payment transactions

- Speeding invoicing by integration with the customer portals

- Proving customer responsiveness via automated order tracking systems

According to the Institute for Robotic Process Automation, RPA can result in up to 50% cost savings. ICSM Australia summarizes on their website, “freight transportation supply chain is ripe for applying RPA to increase efficiencies and reduce costs.”

Case

The Roads and Transport Authority of Dubai has recently integrated Artificial Intelligence and Robotic Process Automation in hopes of optimizing traffic. RPA is expected to improve the operational efficiency of vehicles by 3%. The new technology will be especially beneficial for the taxi business, as it will make data more precise by 10%, allowing for better forecasting of areas with the highest demand and prioritization of driver distribution accordingly. According to the RTA, the introduction of robotic process automation will boost trip acceptance by 15% and reduce HR costs by 20%.

AIoT for Enhanced Freight Delivery Network Efficiency

Weather tracking fleet locations via edge computing, or freight delivery scheduling via RPA, interconnection of all the shipment participants in a transaction is crucial. This is where AIoT comes in handy. AIoT is an intersection of AI and the Internet of Things that comprises people and devices working together in a single edge network for enhancing AI real-time decision-making for better performance.

Information gathered from the devices participating in freight delivery and processing due to AI technologies is helpful for:

- Preventive maintenance

- Lower costs of energy (due to analyses of optimal fleet operations)

- Infrastructure optimization

- Driver compliance identification

- Fuel management

- Equipment reliability auditing

McKinsey estimates that the AIoT market by 2030 is worth potentially $5.4 trillion. And the fact that freight delivery giants implement these techniques proves its popularity.

Case

DHL established smart warehousing options using AIoT with temperature-controlled facilities, dedicated and shared operations, and the first robot-picking cell to tackle the problem of “man’s hands” errors. DHL appreciates AIoT technology for its asset utilization opportunities, increase in agility, and automation of repetitive processes.

Blockchain To Simplify Cross-Border Shipping

Freight companies perform numerous transactional, operational, and interactional processes on a daily basis. In 2017, 500 members from 25 countries established BiTA (Blockchain in Transport Alliance) to drive the adoption of blockchain technology in the freight transportation industry. It deals with the challenges of transport payments safety, freight monitoring, and shipping quality control as well as transparency and trust throughout the supply chain.

A decentralized distributed digital-based ledger tracks the transactional flows and data in blocks across the whole network. Records can be displayed for everyone anywhere, and new blocks are created every time a new transaction occurs. Blockchain deals with keys and hashes: a key gives access to a certain part of the contract while a hash algorithm turns any amount of new data into the hash.

Case

The Blockchain Transport Alliance (BiTA) was created as a reflection of blockchain importance for the global freight circulating. The Alliance has 500 members in 25 countries, collectively generating $1 trillion in profit. They appreciate blockchain technology for:

- Operational security

- Smart contracts

- Transaction privacy

- Secure records storing

- Connecting information blocks into a single network available for every user

Big Data As a Background for Any Other Technology Implementation

Xeneta, a leading ocean and air freight rating platform, describes Big Data as a piece of traditional (fuel costs, transit times, insurance issues) and non-traditional (changeable data, e.g., GPS alerts about closed route road or RFID metrics) information. They emphasize big data as being extremely important for decision-making in freight transportation. Key uses of freight big data are analytics for shipowners, data engineering, vessel performance management, and fleet situational management.

Here are some key application areas for big data:

- Bartering: the main charter’s function is to provide the most economical shipping for freight. The more information variables will be available both for the carrier and for the shipowners (ETA, vessel specification, market information, load size), the more easily they can match the best freight transportation deal. AIS (automatic identification system) is utilized to unite and integrate big data.

- Operations: operating a vehicle at an optimum speed and fuel consumption is crucial, but it depends on the particular car and its maintenance level. Big data processing can help choose the optimum operational mode.

- Voyage operations: tracking any voyage performance-sensitive data (ETA, speed, weather, route changes, etc.) is helpful to stay profitable under variable conditions.

- Vetting: getting feedback from the entities (inspectors, terminals, port authorities) to keep track of the vehicle state.

Case

UPS has recently started to implement RFID tags in its facilities. This technology uses radio waves to track items and enables them to gather relevant data on each separate tagged object with embedded sensors. This project is part of UPS’s smart package initiative, which aims to reduce non-operating costs and the amount of repetitive manual labor.

Prescriptive Shipping to Effectively Manage Risks

Effective freight management is always about huge amounts of data. Thus, carriers have access to real-time data and need to analyze it to forecast necessary steps to fulfill the delivery at its best rate.

Prescriptive shipping is one of the ways carriers can eliminate risks or at least anticipate them.

Case

Amazon patented “anticipatory shipping,” which involves moving the products toward the customers even before they have purchased them. They planned to do this via machine learning (ML): analyzing customer big data and send the items they were likely to buy. Amazon has shared some steps to utilize prescriptive shipping successfully:

- Ensure organizational readiness

- Secure executive buy-in

- Test, learn, retest, relearn

- Ensure operational capacities

Amazon’s transportation mantra is “Data is power.” You can pay attention to how often their page with “Related Items” or “Inspired by your browsing history” changes. Where anticipatory shipping is concerned, Amazon is committed to prescriptive big data analytics.

Autonomous Vehicles: Transfer Hub Model

Since the middle of 2021, the market for self-driving vehicles has recovered and started to grow. Global Market Insights forecasts that the autonomous truck market size will exhibit a growth rate of 17% between 2022 and 2028.

While speaking about autonomous trucks moving from A to B point, many specialists refer to the transfer hub model as increasing technical feasibility. This autonomous vehicle (AV) transportation is focused on the following concept: deploying drivers in congested urban environments (humans located in the hubs are responsible for local street driving to minimize risks). They drive AVs throughout the city area toward the hubs, and then driverless cars reach the next hub, following a special route.

The benefits of AVs are obvious: decreased human factor influence, minimized risks, reduced administrative running costs; the route will follow an optimum speed level, which eases ETA and ATA metrics balance.

All technologies in freight transportation are interconnected: AIoT catches device data, analyses it to turn into qualitative big data for decision making, and prescriptive shipping utilizes big data analyses to predict route metrics variables. They all contribute to the digital transformation of the freight market to make companies stay competitive and profitable.

Summing up: what technologies drive the freight market

All tech trends in the freight transportation industry are focused on mobility, ownership cost reduction, and sustainability. Under the growing freight market, it’s crucial to stay competitive by applying RPA for operations efficiency, edge computing for safer and easily accessible delivery fleets, AIoT for establishing interconnected united delivery networks, prescriptive shipping for better freight management, and autonomous vehicles to speed up freight dispatching as well as human risks reduction.

Market leaders in the freight industry utilize technologies for generating profits while also staying socially responsible and sustainable:

- Scan Global Logistics (SGL) aims to minimize their airfreight emissions. Their new partnership with Neste, the world’s largest producer of Sustainable Aviation Fuel (SAF), could potentially drop their aerial carbon footprint by up to 80%.

- Crowley is currently constructing America’s first fully electric tug – a zero-emission ship, set to debut at the Port of San Diego later this year. According to their website, “the 25-m tug will generate 70 tonnes of bollard pull without a single drop of MGO”.

- Maersk is building the first smart green flagship logistics centre in Shanghai. This new facility will apply for the highest certification level at Leadership in Energy and Environmental Design, bringing Maersk closer to their goal of zero emissions by 2040.

- Deutsche Post DHL Group introduced “Sustainability-Linked Finance Framework” which uses absolute annual CO2 emissions as a key performance indicator. Missing environmental targets are tied to debt instruments, and the company has a direct financial interest in remaining sustainable.

FreightTech trends are about anticipating and meeting the industry’s technological challenges head on, such as embracing global visibility, providing real-time data aggregation, and processing freight transportation data. Software development companies contribute to the democratization and innovation of the transportation industry for future growth and sustainability. Innovecs is a prime example of how digital expertise can enhance operational productivity in the logistics sector in the age of digital transformation.