How Financial Electronic Data Interchange Adds Value to a Business

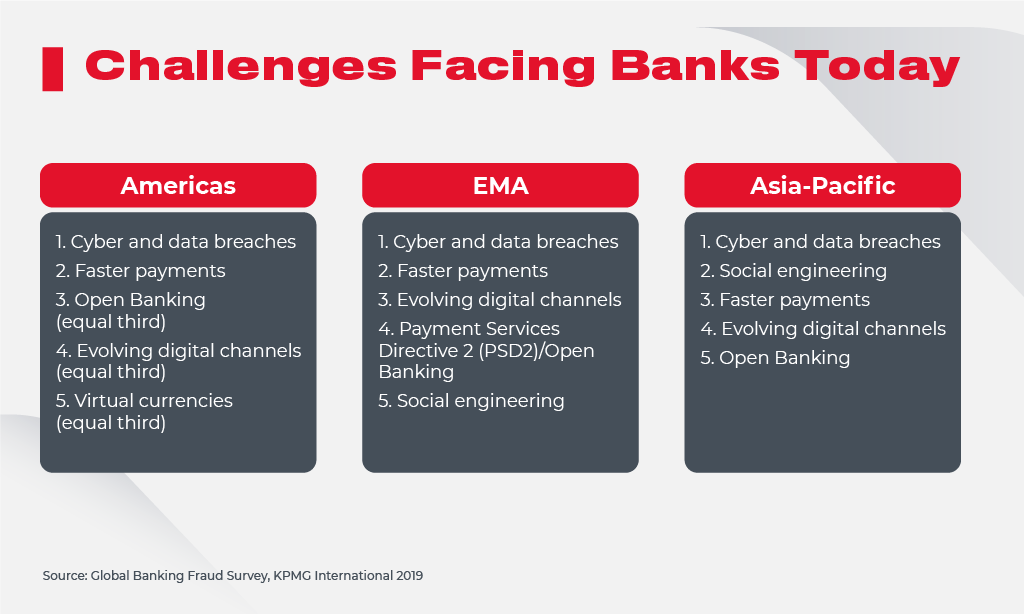

The recent banking fraud survey in 2019 revealed that modern financial institutions (FIs) have to overcome many challenges, including cyberattacks, data breaches, slow payments, and adopting digital tools. These hurdles are the main reasons why banks and financial firms have faced low efficiency and decreased customer satisfaction. All this inevitably leads to a drop in revenues.

The payments today need to be faster and the security within banks needs improvements. Thankfully, the highly digitized fintech industry offers the solution – EDI or electronic data interchange. For the financial sector, EDI means seamless transactions, enhanced security, automated processes, fewer costs, elevated customer service and more. Look under the hood to see how EDI works.

What is Financial Electronic Data Interchange

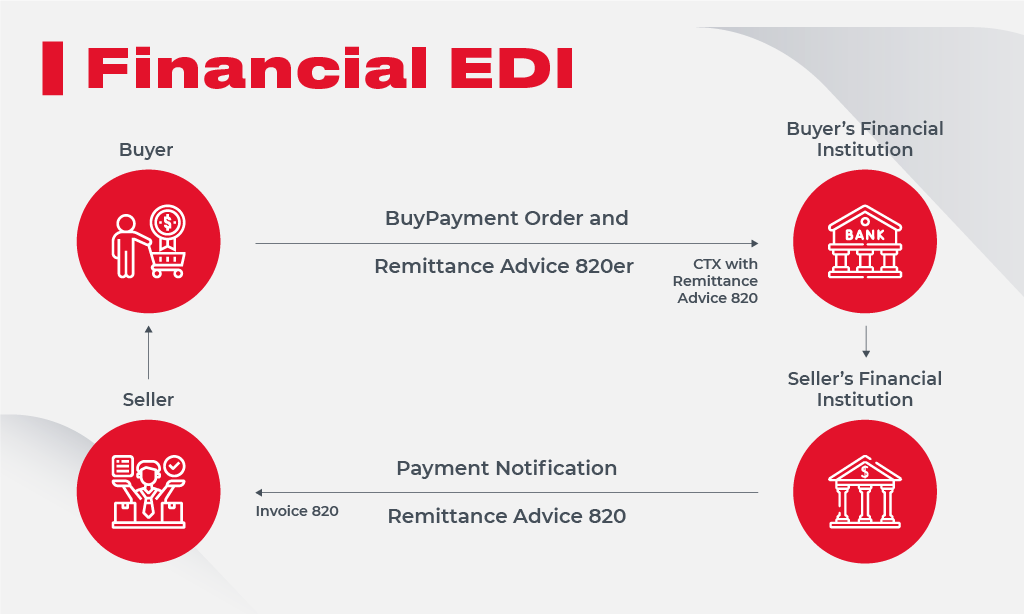

Unlike standard EDI, the financial EDI (further referred as FEDI) deals with payment data exchange. It mainly incorporates the electronic movement of payments, data related to them and other associated assets in a particular format. Also, FEDI involves a bank for payment movements. Therefore, the buyer and merchant have banks as their third-parties to conduct a FEDI transaction.

Financial EDI is crucial for a modern globalized economy allowing for mass-scale transaction transferring in a faster and time-effective manner. Financial firms exploit FEDI to exchange payments, while state agencies rely on it to conduct tax payments. Today, 60,000 US organizations are already using EDI, and numerous firms have started to embrace FEDI.

Subsequently, the share of products and services delivered by banks using digital solutions is growing. The global payments report of 2018 states that the number of e-transactions will have a CAGR of 12.7% by 2021, fostering the adoption of FEDI.

How financial electronic data interchange Works

A company requires a few actions to run a non-cash payment using FEDI. The initial step is when the buyer retrieves e-payment data from the company’s billing system. Further, this information is converted into a FEDI format.

Then, the FEDI-based transaction is forwarded to the company’s bank, where it is transformed into an ACH payment. After that, it sets off to the electronic banking system called ACH Network. Once the seller’s bank receives the payment and related data, it adds money to the seller system.

Why Using FEDI is Justified

Banks, credit unions, loan firms, and other financial firms are always overwhelmed with delivering a broad spectrum of services to their customers. All this leads to generation and processing a great deal of data. The more data, the more complicated it is to handle it.

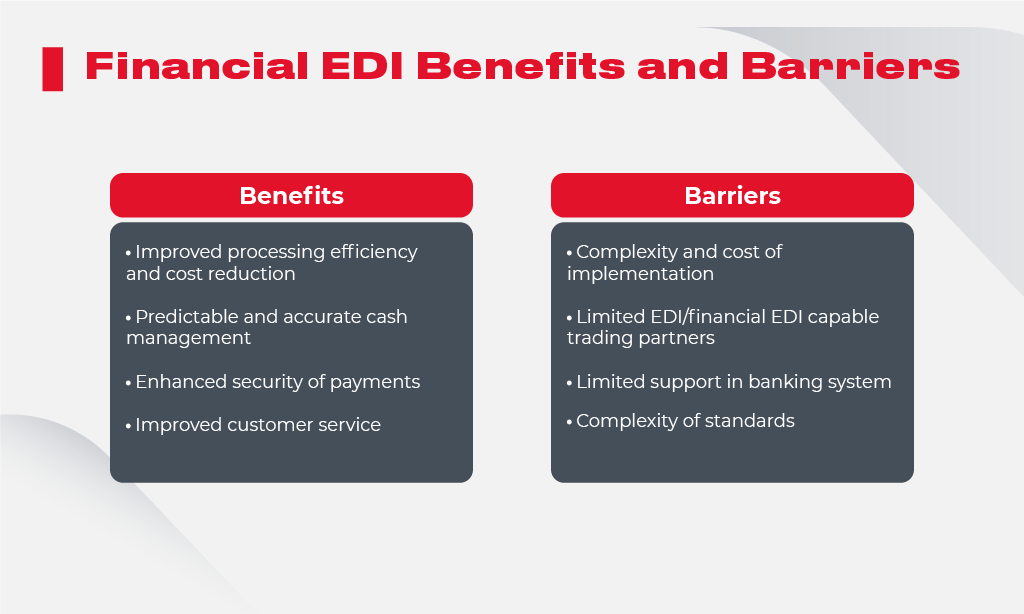

With FEDI, any financial firm can streamline the cumbersome processes. Namely, the electronic data interchange allows you to automatically process the large data sets, reduce operational duties, and get rid of data entry errors. Also, FEDI is beneficial for the end-to-end transactions as businesses get their time, and resource management drastically improved. Below are some practical advantages of using FEDI:

Automation and Fewer Costs. FEDI’s primary advantage is the automation of the processes related to sending invoices and initiating payments. With some financial activities done autonomously, business executives save operational costs, time, and labor resources. Since human errors usually cost organizations a lot of money, implementing FEDI will eliminate the need for human involvement.

Faster Payments and Conversion Cycle. In addition to cost savings and automatization of processes through FEDI, financial agencies get their payments faster. Electronic transactions are much speedier rather than their traditional counterparts – physical checks. Consequently, FIs can accelerate their cash flows from operations.

Enhanced Productivity and Better Accuracy. As we mentioned above, automation through FEDI allows for fewer employees’ manual work. Therefore, some operations can be performed almost instantly, while managers can take on more valuable for business tasks.

Plus, financial electronic data interchange is an excellent way to minimize transaction failures. When both parties stick to the FEDI standards, the payment activities are usually treated accurately and transmitted flawlessly.

Sustainability and Improved Company’s Image. When an organization chooses to go green, it goes through pitfalls and finally gets rewarded. FEDI can play here a pivotal role by allowing businesses to simply switch from papers to electronic transactions, invoices, and checks. The less paper you use, the less CO2 emissions are. Thus, FEDI promotes the reputation of an organization and encourages it to run sustainable supply chain management.

Increased Financial Ratios. If a company implements FEDI, it starts to reap benefits right out of the gate. Transmitting and receiving of electronic invoices becomes instant. Also, FEDI reveals opportunities for automatic authentication and verification that enables fast payouts at the endpoint, helping to evaluate cash requirements. While customers can take advantage of the quick payments, dealers boast of enhanced market liquidity.

Secure Payments and Fewer Cyber Crimes. What makes FEDI beneficial is providing advanced security for any transaction by securely distributing data across a wide array of communicating protocols and safety standards. Such a decentralized protection system helps to mitigate the risks of cyberattacks.

Better Customer and Partner Service. Using FEDI, a financial organization finally achieves enhanced levels of satisfaction for both end-users and partners. Speedy and autonomous processes, green initiatives, better security. All this fosters a seamless functioning of the payment system, making all stakeholders happy.

Applications of FEDI Transactions

To understand why financial electronic data Interchange is important and how it revolutionizes the way traditional payment system worked, we picked some examples of using FEDI. Below, we give some familiar examples of FEDI transaction codes:

- 144 is a kind of electronic report containing actual data about ownership transfer and confirmation status of student credit. The transactions from EDI144 can be exploited to deliver information associated with the loan ownership transfer, to request the status of the loan from its guarantor, etc.

- 829 is a transaction set used to expedite annulled electronic payment procedures that have been performed by the originating company to its financial agency. This FEDI document should be developed prior to releasing the funds.

- 154 is a very popular transaction across the United States. It is commonly used to safely transfer interest filings, file a form UCC1, or file liens, judgments, and other similar forms.

- 820 is an electronic document used by commerce parties to exchange payment or remittance advice, such as receipt of an invoice, payer or payee identification, bank and account identification, and other related documents.

- 828 transaction set helps payer to send a report, including debit information to a payee. This information is stored at a financial firm and then compared to incoming debit transactions to verify whether the account owner approves them. This FEDI document contains the latest updates on new authorizations. It also can be used to cancel existing permissions.

financial edi Gains Popularity by Improving Other Sectors

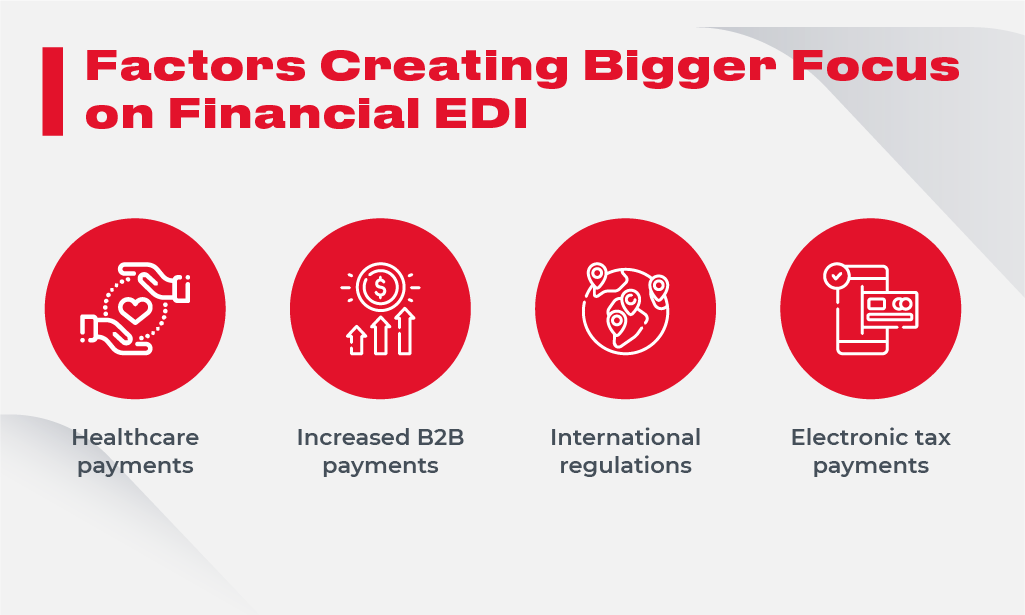

There are sectors where financial electronic data interchange is thriving. The latter include healthcare and B2B payments, global payment regulations, and state government tax payment regulations.

Healthcare payments seek for FEDI implementation. As HIPAA approved using FEDI in healthcare, many procedures became more efficient. The FEDI transactions uniquely developed for healthcare incorporate 835 (for submitting payments), 820 (for compensation deductions), and 837 (for providing claim information).

Another driver is the growing number of B2B payments. Global commerce is spreading, and it’s not rocket science that your suppliers may originate from other continents. FEDI offers quick payments and, in turn, quick receiving of payments. That feature is vital in today’s trade relationships across the world.

Global regulations also grow the popularity of FEDI. NACHA, the non-cash payment provider, demands from payment gateway companies to provide order remittance advice such as invoice receipts, making FEDI a necessity. Since FEDI enables this function, sensitive electronic data can be moved quickly, safely and seamlessly.

Collecting tax payments by government agencies. Here is where financial electronic data interchange is also beneficial. The IRS exploits a specially designed automated system for tax payments management. This is an utterly secure government online service enabling citizens to pay federal taxes electronically.

Summary: Make Use of FEDI to Optimize Payment Procedures

The fact is that many FIs and even state agencies are embracing FEDI to manage their payment procedures and for a good reason. They realize the benefits and new opportunities:

- Automation of processes and cost reduction

- Fostering green initiatives

- Reducing manual work and focusing on the core tasks

- Enhanced productivity and better accuracy

- Secure and payments

- Higher satisfaction levels of all stakeholders

If you seek a trusted partner to streamline financial procedures within your organization, Innovecs can offer expertise in modern fintech solutions. Our specialists can build a robust FEDI solution tailored to your company’s goals. The products we create help businesses to interact with their B2B partners seamlessly, securely exchange data, and consolidate internal business processes.