Data Science in Finance: 6 Use Cases that Changed the Industry

SAS CTO and COO Oliver Schabenberger in his interview for IT Brief stated: “Many companies in BFIS (banking and finance sector) are struggling to become more data-driven. It can be disrupting, when it comes to deep digital transformation. But one needs to understand data interpreting, obtain methods to move and apply data, and models to gain valuable business insights. The company has to update data models continuously. And all of a sudden they become really data-driven with many benefits performed.”

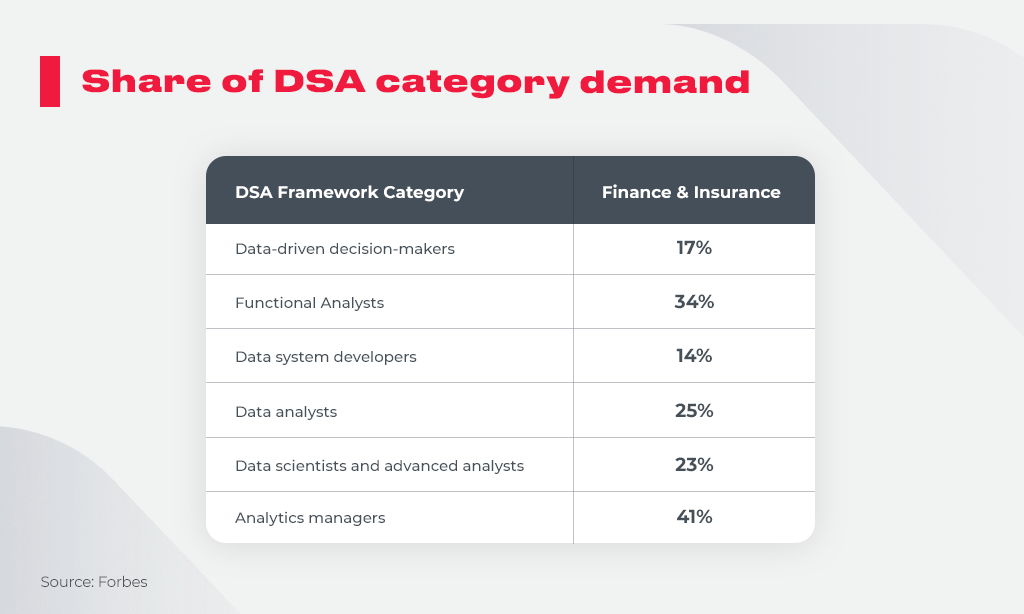

IBM calculates 59% of all data science and analytics (DSA) job demand is in finance and insurance now. Recently published data science reports draw the attention of enterprises to AI models’ potential for faster ROI. At the same time, gaining skillful data scientists is a real challenge in the modern job market.

These facts and figures prove data science’s ability to change the whole industry and propose new opportunities to the finance sector.

What Is Data Science?

Data science is a set of methods, tools, and operations to process data and extract valuable insights. It’s a ground-breaking field of technology leading to revolutionary changes similar to those, which took place with the personal computer or Internet invention. Many years ago computers got work algorithms from a man but nowadays it’s an outdated approach. People give basic input data for the computer to process and certain algorithms to teach it how to learn. As a result, machines are dealing with information on their own without pre-set algorithms, and gained insights are more sophisticated. In such a way data science in finance keeps information analysis streamlined without human work. Analysts use automated algorithms and complex analytical tools, machine learning (ML) or deep learning (DL) as modeling algorithms to establish links between data, gain knowledge, and draw predictions. Global enterprises focus on data science application to gain new markets and scale their businesses:

- Giant Chinese companies Alibaba and Tencent were competing to host the ID services when China was putting the ID cards on smartphones in 2019;

- AliPay uses Apple’s Face ID or Touch ID to verify the user’s identity (fraud prevention measures);

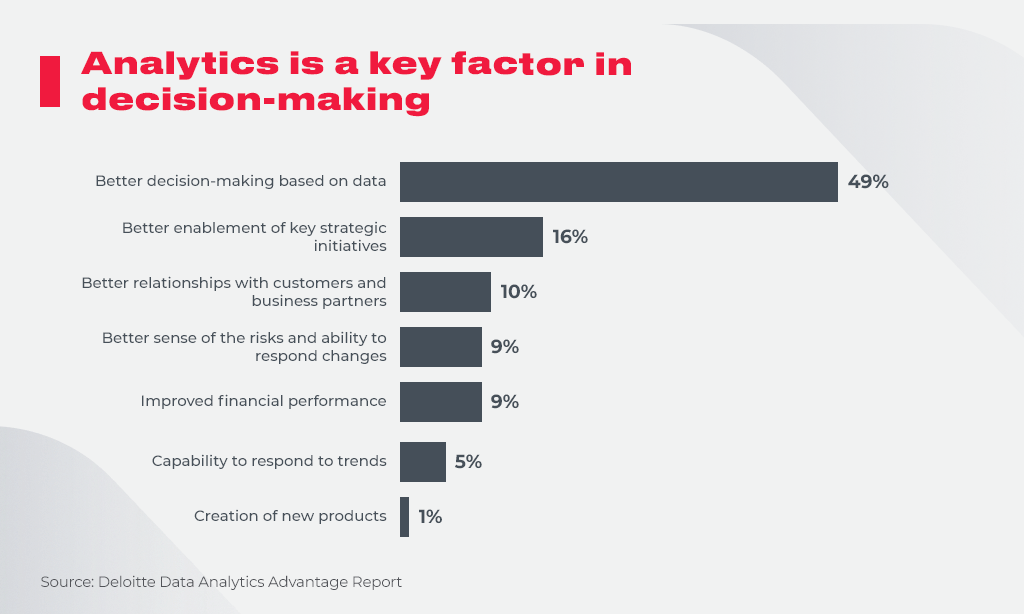

- Deloitte states that financial services companies are using advanced data analytics to meet regulatory and security requirements better and smoother. They note the importance of data in decision-making based on the “economic necessity of correct and quick decisions”.

Data science is a key driver of companies’ better relationships with the customers, high sense and awareness of the financial risks, more capability to respond to buying trends, and, as a result, revenue increase after data-based tools implementation.

In AI Today Podcast #91 Anthony Scriffignano, Senior Vice President & Chief Data Scientist at Dun & Bradstreet, shares his experience in big data. He stresses that data science is really able to change the finance industry. Expert says about limitations in machine learning algorithms application and describes how enterprises can deepen their expertise in utilizing big data for their specific needs. Anthony works with the “world’s largest commercial database” (Forbes) and highlights crucial issues of data science use cases in finance. For example, he identifies financial fraud as “a sort of information misrepresentation for financial gain” and recommends using regressive methods (dealing with pre-examples and pre-existing data) to mitigate fraud risks.

Data science is a way to gain more useful applicable insights from the captured data.

Data science in finance drives a lot of benefits for existing businesses in the financial sector. And these perks motivate companies to implement big data solutions more intensively.

Top 6 Use Cases Of Data Science In Finance

365 DataScience education center treats data as the most valuable asset nowadays in the finance industry, and notes “financial enterprises are striving to obtain exclusive rights to data”. Having the right information they can construct better models, enhance their business, and get ahead in competing and generating more revenue. Let’s shed some light on top use cases of data science in finance.

We start with cases on how data empowers different kinds of analytics: risk, real-time, and a consumer one. Banks may not prefer to invest much in big data tools to meet regulatory measures, but they are really interested in a better understanding of the market influence on net interest margin and capital. Analytics based on big data brings performance improvements. But it’s still not applied to the full as it is stated in “Finance Redefined: Workday Global Finance Leader Survey”. They specify only 35% of the respondent financial institutions report usage of advanced analytics.

Risk Analytics

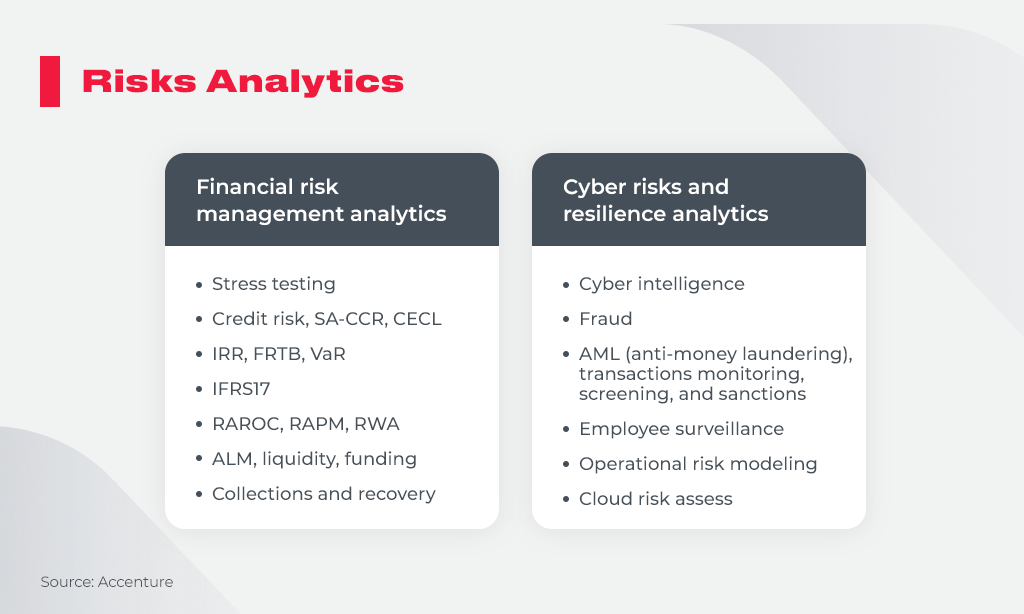

Risk analytics is another category of data science application in the financial domain to mitigate cash flow uncertainty, suspicious actions with the stock returns as well as forecasting future economic state stability. The global risk analytics market is expected to reach over $65 million by 2026.

Quantzig counts risk analytics assists financial organizations in reducing defaults by 50%. Special analytical tools allow companies to avoid financial losses and address both financial and cyber risks:

All the above-mentioned tools function in the form of financial risk management software and deal with:

- Safeguarding against fraud losses;

- Providing total control over payable operations;

- Guaranteeing compliance with OFAC (Office of Foreign Assets Control) and FATCA (Foreign Account Tax Compliance Act);

- Advanced accounting options such as “what-if” and cash flow analyses;

- Consideration of extreme actions to advise the best trade-off between risk and return;

- Identifying theft and manipulation attacks;

- Remote customer onboarding online, and etc.

Financial Times emphasizes machine learning is of great importance in the finance domain as a group of techniques applied by the data scientists to make computers learn from data to prevent risks. They write about serious challenges pending for global response:

Today, machine learning is deployed mainly in back-office functions such as anti-money laundering, fraud detection, and credit risk management. It is not currently used much in front-line trading functions, but we expect a material change in this area over the next few years. We, therefore, have the responsibility to consider potential risks and to mitigate them, as far as possible. Unlike traditional rules-based algorithms, machine-learning algorithms are not static engines, programmed to run only along the paths created by their human programmers. This is a transformative moment for those trading in financial markets. Machine learning creates the potential for unexpected or unfair changes in pricing or liquidity for certain types of market users.

Bank of England has published a survey recently, where half of the banks and capital market companies proved they applied data science to meet risk analytics needs. These facts illustrate the popularity of data science in the design of risk analysis solutions.

Content Delivery Network (CDN) distinguishes the following tools for risk analytics (for sell-side, buy-side, and traded markets):

- those, giving a complete picture of valuation adjustments arising from counterparty credit risks;

- tools for stress testing concerning FRTB (The Fundamental Review Of The Trading Book) compliance;

- credits approval model considering third-party risks;

- cloud-based scenario engines to assess financial risks for your portfolio.

Use Case Fact. Accenture calculates 73% of banks are going to increase investments into risk analytics by more than 10% in 2021.

Real-Time Analytics

In the field of analyzing data and gaining economic insights to enhance business revenue, real-time analytics is quite popular. Gartner defines it as an application of logic and math to provide background for quicker decisions. The most vivid example of real-time analytics is a scoring system that helps the bank to decide on an immediate loan extension.

Real-time data can bring the following benefits to the business:

- shortened reaction time to the fraudulent or risky situations;

- testing your marketing program or pricing schemes in real time;

- monitoring customer behavior;

- providing important real-time data in the format customer is willing to have;

- adding business intelligence features to your existing software.

Andreas Cretz, the expert of Global Big Data Community and CEO of Team Data Science, shares his view on real-time analytics in the following video:

Use Case Fact. Trulia, a real estate platform, uses a real-time analytics tool, the real-time streaming pipeline to message the marketing department concerning the resource adoption and in case of more traffic necessity to perform website efficiency.

Consumer Analytics

Consumer analytics usually starts with the common questions: whether the existing channels bring enough customers, which customer category brings the most revenue to the company, places of losing the customers, and what options attract more buyers.

Data science applied for consumer analytics delivers the following tools:

- Various CRMs (e.g. Zoho);

- Social media dashboards to optimize communications with the customers (e.g. Hootsuite);

- Customer service analytical options.

Head of Analytics at HSBC explains top use cases of customer analytics in his LinkedIn. It is specified there that analytics is mainly driven by social media channels and gives powerful insights to propose the best next offer for the client or gain more retained customers.

Use Case Fact. A cargo airline gained a 20% boost in customers’ wallet share providing the sales team with a simple dashboard, where prices, flight capacity, and competitors’ options were highlighted.

Customer Data Management & Personalized Services

It isn’t a revolutionary statement that poor customer data management in banking and finance leads to huge money losses. Thus, for example, in Harvard Business Review the loss of $1.3 trillion dollars annually was calculated. In this review, they stress the importance of customer data management to know which financial product the customer already has (e.g. Visa card for payments) and which product or service is reasonable to propose (e.g. overdraft amount considering customer payment profile).

Exponea shares their expertise and says 2021 brought new methods of leveraging customer data to provide personalized financial services (e.g. providing credit bargaining in response to the client’s interest detected). Here are the essentials in dealing with the customer data:

- Collect the right type of data to complete overall customer vision;

- Turn customer data into company cross-department knowledge using CDP (customer data platform);

- Establish a Single Customer View to smooth the usage of communication channels and perform real-time performance monitoring.

Once you learn customer’s financial habits perfectly well, you are able to utilize this information and propose services personalization in the following ways:

- Perspective personalization: the anticipation of customer’s wishes and needs, making “best deal” proposals to sell more, or creating personalized blog content;

- Real-time personalization (e.g. real-time advising customer while his or her shopping online);

- ML personalization: AI-driven communication with the customer.

Due to the power of personalized services business gets increased engagement rates, customer return, strengthened marketing ROI, improved customer experience, consistent communication throughout the existing channels.

Use Case Fact. Wunderman Thompson uses a combination of IBM Watson Studio and open source tools based on machine learning to discover more customers’ insights helping to increase ROI.

Financial Fraud Detection

Fraud prevention is a substantial part of financial security (identity theft or credit card schemes, abnormally high transactions, or out-of-region purchases). Integration of the data science in the fraudulent activities analysis performs a number of benefits:

- Detection of the suspicious activities are given in real time;

- Quick extracting of incomplete and inaccurate data;

- Productivity increase in repeated claims addressing;

- Higher return on investments.

European Payments Council reports a growing number of cashless points of sales, streamlining the consumer’s experience, and, hence, 66% of financial transactions performed from mobile and are under cybercrime danger. The fraud detection market under a pandemic world situation is growing quickly.

One Span establishes Buyer’s Guide to evaluate fraud detection tools. In this context they draw user’s attention to the criteria of a good fraud detection solution:

- it is the tool capturing patterns in the user, device, and transaction data;

- software able to indicate immediately that a customer is under attack.

The very idea of fraud detection is to be ready for unpredicted events. ML algorithms spot the attack scenarios to assure the absence of losses for all the parties involved in financial transactions. There are different scripts of data processing in terms of fraud detection. One of them is called Hybrid Microsoft Security Monitoring and concerns the back-end components of a “real-time analytics pipeline”. Mobile phone metadata is transmitted to the Azure IoT hub (Microsoft connector to the cloud) and stream data analysis is launched automatically. Then, data is segmented into units, each of them is processed on the basis of special algorithms to decide whether it was a suspicious activity or not.

Use Case Fact. AI on IBM cloud helped to identify five times more fraud claims for Thelem Assurances.

Algorithmic Trading

Algorithmic trading is a machine trading on the market. In the case of such automated trading, the traders do not need to take part in the process. Trades of different volumes happen multiple times every second.

It is a way of trading using a computer program ruled by the set of instructions to place a successful trade. As an example, you can imagine the following algorithm: buy 100,000 Apple shares fell below $200, and for every 0.1 % price increase, buy 1,000 shares more. Timing, price, quantity are considered to generate automatic advice on trading.

Algorithmic trading helps to follow the best pricing proposals to get more revenue, ensure instant order placement, decrease the risk of manual errors, enhance lower transaction costs. It enables HFT (high-frequency trading), which places multiple orders at a time.

This kind of trading comprises a number of strategies followed by the developed software:

- Trends following: extracted data is analyzed, trends become visible, and order placement is ruled by this;

- Arbitrage opportunities: buying in one stock and the simultaneous selling in another brings risk-free profits, enabled by processing data and knowing about the dual-listed stock;

- Volume-weighted average price (VWAP): splitting a large order into smaller ones to trade more effectively.

Sociologist Alexandru Preda communicated with Forbes and noted trading programs numbers have increased over the past four years due to the cheap tools for their creation on the market as well as easy cloud access to the algorithms for trading services.

Use Case Fact. Tim Richardson, a former football player, Rizm (financial software) account holder, reports he can follow about 30 trades a day in comparison with 3-5 manually.

On the market, there are both ready-made products to perform automated trading and custom solutions. One can also come across browser-based development platforms such as Quantopian, which provides standardized tools for dev grades to test their programming skills and design personal algorithms. However, you can also develop your own tool that will meet your specific trading requirements (e.g. to perform a certain number of trades per minute under predefined share price reached).

Bottom Line

Data science takes a very important role as it is evidenced by its wide utilization in financial risks forecasting, high level of investments in automated fraud detection software development, and increased interest in algorithmic trading. Observed materials led us to the following takeaways:

- Data science can be applied to develop sophisticated software for advanced analytics, fraud prevention, better customer experience management, and algorithmic trading;

- Machine learning performs quick insights in customer’s financial behavior, fraudulent activities noted, or possible future financial risks;

- Use cases prove to us that data science resources are deployed actively to enhance finance business via risk prevention with the help of regressive analytical tools; scoring the credit extension in real time; fraudulent behavior tracing; performing critical customer data asap.

Data science is defined by both Forbes and Financial Times as a methodology, which is introduced via intensive implementation of AI and ML tools. The sector has a great potential to grow and a lot of new solutions will be introduced on the market to ease business operations in 2021. Datanami defines the emerging trend of huge investments in data science under a strong cost-cutting policy because of pandemic negative influence. Because businesses stress they see the survival perspectives in AI and ML utilization.

Innovecs has relevant experience in building intelligent risk management, customer analytics, data management systems. Our teams have helped many clients globally to achieve their business goals by developing custom solutions that meet their specific needs.

We do hope after reading this paper you gain new insights concerning how data empowers the financial domain and how financial software development enhances your business to strike new challenges. So, if you want to stay ahead of the competition, just contact us and we will help you become a data-driven company.